FICO Credit Score

The FICO credit score is one of the well known credit scoring models in the United States which was first introduced in 1989 by Fair, Isaac, and Company. The FICO model is used by the vast majority of banks and credit grantors, and is based on consumer credit information maintained in the files of Experian, Equifax, and TransUnion which are the three main national consumer credit bureaus. Because a consumer's credit file may contain different information at each of the bureaus, FICO scores for the same person can vary depending on where the consumer information is obtained to generate the score. Also, not only the same FICO credit score can be different for the same person, but there are many types of FICO scoring models which are used for different purposes as we will discuss.

There are also other non-FICO credit score types which have their own criteria and credit risk calculation models which indicate the credit worthiness of a person with a numeric representation. Depending on the type of credit score, the credit worthiness number resides in a range of numbers determined by each credit scoring model. For example, the classic FICO score resides between the numbers 300 and 850. The higher a consumer credit score, the more chances the consumer has to obtain a low cost loan, and, the lower a credit score, chances are that the lenders will not approve a loan or if the loan is granted, it will have more restrictions such as faster pay-off cycle, collateral requirement, and a higher interest rate. A credit score tells lenders how risky borrowers are, and when and how likely it is that the borrower will make payments on the loan based on the criteria that each credit model has pre-determined. Credit scoring schemes make lenders more comfortable about making credit decisions and as such credit is more abundantly available to low risk individuals who need to borrow money. This is a win-win for lenders and people with good credit history who need money to improve their lives.

FICO score ranges

As mentioned, there are not only many other credit scoring models but even FICO credit score offers a variety of credit score types such as generic or classic, bankcard, personal finance, mortgage, installment loan, auto. Each scoring model is created to assess the risk of a borrower in a particular loan category.

FICO Credit Score Criteria

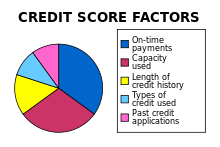

Credit scores are designed to measure the risk of default by taking into account various factors in a person's financial history. Although the exact formulas for calculating credit scores are secrets, FICO has disclosed the following components:

- Payment History

- Debt

- Length of credit history

- Types of debts

- Number of new credit accounts

- Money owned due to negative circumstances such as court orders

Check Your Credit Score

Consumers are encouraged to review their credit score from time to time to see which direction it is headed whether higher or lower. The unusual movement of the credit score toward lower numbers may indicate some hidden information in the credit report which requires investigation for identity theft detection purposes.

There are many ways consumers can obtain their free copies of the credit reports and free credit scores. For example, www.annualcreditreport.com offers one free credit report from each of the three consumer credit agencies every year, and, you can get a free credit score from Quizzle.com which gives you a free credit score from CE Analytics, called a CE Score, and a credit report from Experian every 6 months. If you need your credit scores and reports more often, then you can pay to receive more frequent information.